For companies following accounting year as January – December in the UAE, the first tax period shall begin with January 2024. In such case, current year 2023 assumes significance as it’s a year immediately preceding the year 2024 when CT law effectively becomes applicable to them.

Tax departments which are based in-house in companies are often challenged to meet constantly changing requirements. Our experienced professionals will ensure a smooth and seamless transition to the new era of CT regime within the UAE. This way your team’s burden is lessened. Our corporate tax teams are already working on tax impact assessments, transfer pricing reviews, cross-border transaction reviews and planning operational implementation for several businesses in the UAE.

The aforesaid phases in the diagram be changed to as under:

- Phase I: Impact Assessment

- Phase II: Transition Support

- Phase III: Compliance Support

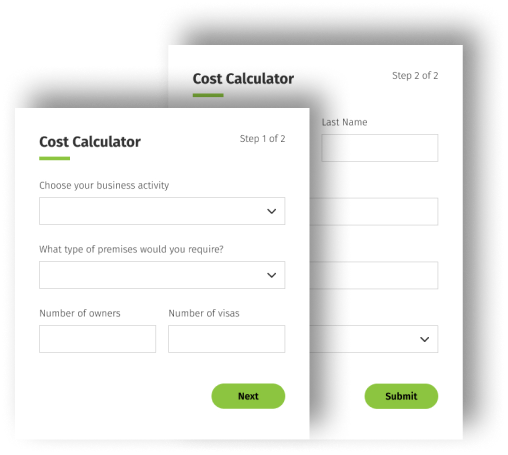

Get an estimate for your desired business in your desired currency in under a minute with this cost calculator.

The corporate tax rate in UAE will be 9%.

Businesses with an annual income of over AED 375,000 will be subject to corporate tax in UAE. Contact us to discuss CT exemptions and to find out Who Will Be Subject to Corporate Tax in UAE.

Free zone businesses that operate within specific zones will be exempt from corporate tax until at least 2069. Contact us to discuss specific Corporate Tax for Free Zone Businesses.