The DIFC Freezone is the leading financial hub in the city of DUBAI. DIFC has its own legal system, arbitration canters and court, with own jurisdiction over financial services, corporates, foundations, trusts and securities laws and regulations.

DIFC’s advantageous business environment is vital for growth and success as DIFC provides streamlined setup, a state-of-the-art infrastructure, and diverse office spaces for businesses.

- Strong legal framework

- Simplified registration process

- Strategic location

- Business-friendly environment

- World-class infrastructure

- Access to talent

- Networking opportunities

- Reputation and credibility

- Regulatory framework

- Access to a reputable financial center

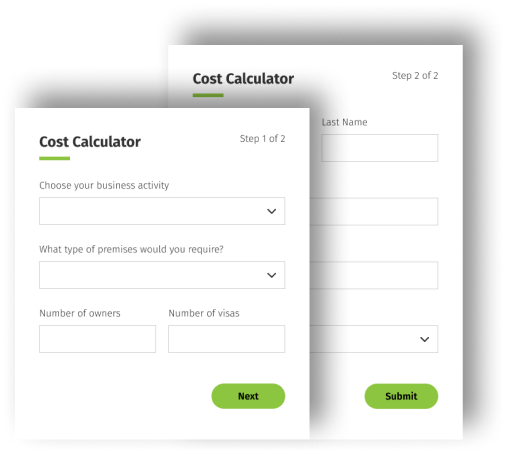

Get an estimate for your desired business in your desired currency in under a minute with this cost calculator.

- Regulatory Environment: DIFC operates under a robust regulatory framework based on English common law principles, providing a secure and transparent legal environment for businesses. The regulatory body overseeing DIFC is the Dubai Financial Services Authority (DFSA), which is responsible for regulating financial services firms and ancillary service providers within the Centre.

- Infrastructure: DIFC boasts state-of-the-art infrastructure, including modern office spaces, world-class conference facilities, and a range of amenities such as restaurants, cafes, and retail outlets. The architecture within DIFC reflects its status as a global financial hub.

- Business Setup: DIFC offers a streamlined process for setting up businesses, making it attractive for companies seeking to establish a presence in the region. Companies operating within DIFC benefit from various incentives, 100% foreign ownership, and no restrictions on foreign exchange.

- Financial Services: DIFC is home to a diverse range of financial institutions, including banks, investment firms, asset managers, insurance companies, and fintech startups. These institutions cater to both regional and international markets, providing a wide array of financial products and services.

- Legal System: The legal system in DIFC is based on common law principles, providing a familiar and reliable legal framework for businesses and investors. DIFC has its own independent judicial system, with a Court of First Instance and a Court of Appeal, staffed by internationally renowned judges.

- Global Connectivity: Dubai's strategic location at the crossroads of Europe, Asia, and Africa, coupled with its excellent infrastructure and transportation networks, makes DIFC a highly connected hub for global business and commerce.

- Islamic Finance: DIFC has emerged as a leading Centre for Islamic finance, with a dedicated focus on Sharia-compliant financial products and services. The Centre hosts several Islamic banks, financial institutions, and advisory firms specializing in Islamic finance.

Dubai International Financial Centre plays a pivotal role in the UAE's ambition to become a global financial powerhouse, offering a conducive environment for businesses to thrive and contribute to the region's economic growth.